A first in the Middle East, DubiCars’ finance search is here to make your car buying experience easier!

What is this new, revolutionary way of finding a car? It’s a simple search function that allows you to customise your search according to finance options. If you’ve been wondering, ‘How do I get a car on finance?’ then look no further.

Our car finance search enables you to quickly find cars based on finance options that meet your budget, with minimal effort. Why have 10 tabs open when you can have just the one? Your new car finance options are just one quick search away.

To make finding your new car even easier, read our guide below on how to apply for car finance online and get a car on finance via our exclusive search.

How does finance work when buying a car?

Buying a car can be expensive. Finance is a great way to buy a car when you don’t have all the funds available upfront.

Through finance, you use a bank loan to spread out the payment for your new vehicle across instalments over a select period of time. In doing so, you avoid the big upfront cost of buying a new car and instead spread out the overall payment into smaller, more affordable segments.

Note: As per our understanding, cars older than five years can’t be financed by any bank according to theUAE Central Bank.

Should I buy my car with cash or finance?

Whether you buy a car outright with cash or choose a finance option is ultimately up to you, but there are certain pros and cons to each:

| Advantages of Buying Upfront with Cash | Advantages of Buying with Car Finance |

| Easy, straightforward process of just a one-off payment. Ends up cheaper in total as there are no interest payments. You own the car from the outset. You can sell the car whenever you like and will receive the full value for it. There are no mileage restrictions. There are no extra fees for wear and tear. As the legal owner, you are free to modify the car. Contracts can be difficult to get out of, so a cash purchase offers you freedom. | You can have and drive a car without needing to save to pay the full value upfront. By avoiding spending all your money upfront, you can invest any remaining money elsewhere, possibly in something that doesn’t depreciate in value like a car does. You may be able to buy a better or more expensive car by spreading out payments over a period of time. |

Step-by-step guide: how to get a car on finance in the UAE

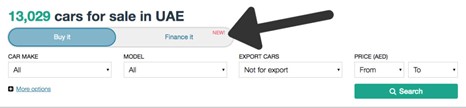

Step 1: Change the search options

On the DubiCars home page, there are two options when it comes to refining your search results. For this guide, you want to select ‘Finance it’.

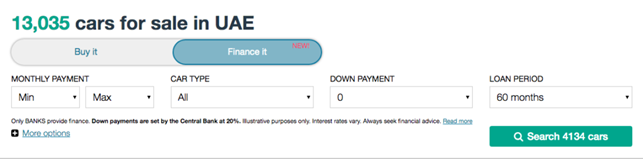

Step 2: Set your parameters

Once you’ve changed the search option to finance, you’ll notice a few different options at the top:

- Monthly payment (min-max) – This allows you to set your minimum and maximum payment per month. AED 200 per month is the lowest available and AED 10,000 is the highest.

- Car type (body style) – This is the shape of the vehicle (SUV, saloon/sedan, hatchback, coupe, etc.)

- Down payment – This sets how much money you want to put down alongside the loan. This is mandatory and most banks require 20%. Values range from AED 5,000 to AED 200,000.

- Loan period – This is the duration of how many months you want to repay the loan over. The minimum is 12 months and the maximum is 60 months.

Step 3: Once you’ve defined your options above, hit search and off you go!

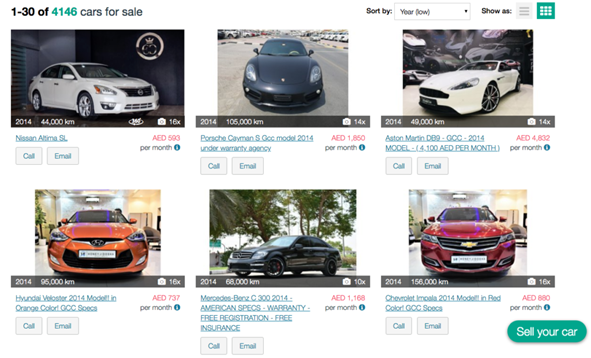

Step 4: Find your dream car by browsing and using filters

Selecting the previously mentioned options, you’ll be shown vehicles that can be financed under your criteria.

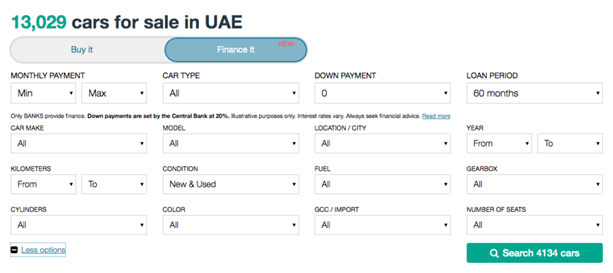

If you are looking for a particular vehicle, there are further filters you can select:

- Car make (manufacturer/brand of the vehicle)

- Model

- Location/City (what Emirate or city the vehicle is located in)

- Year

- Kilometres

- Condition (new and used selectable only)

- Fuel

- Gearbox

- Cylinders

- Color

- GCC/Import

- Number of seats

You can also use the sort function to further assist your search by ordering the available cars by:

- Newly added

- Year (high) – Newer cars will be shown first.

- Year (low) – Older cars will be shown first.

- Price (high)

- Price (low)

- Mileage (high)

- Mileage (low)

- Video & Panorama – Exclusive to Dubicars and shows only cars with premium videos and full 360 interior pictures.

Step 5: Now that you found your dream car, it’s time to send off a finance lead to the seller.

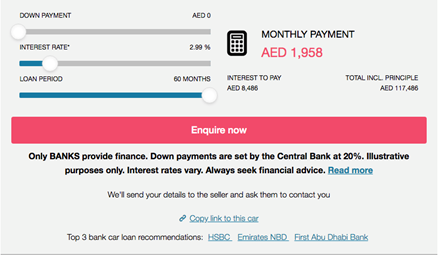

Once you’ve found the perfect car you, click the link and scroll down. Underneath the specs, you’ll find the box pictured below.

Here you can configure the down payment, interest rate and the loan period. On the right, you’ll notice the amount you need to pay monthly, which changes depending on where you move the individual sliders too. Changing the position will adjust the interest you’ll pay over the loan period and the total amount you’ll pay throughout the loan duration.

Note: These numbers are for illustrative purposes only, please contact the bank directly for exact figures.

Step 6: Obtaining the loan

Now that your car finance repayment has been calculated, click the ‘Enquire now’ button and a finance lead will be sent to the seller.

Note: Neither DubiCars nor the dealers provide the money for financing a car. You will still need to contact the bank yourself. Click here for more information.

Start the process today: find your next car on finance in the UAE

Click here to find DubiCars’ car finance search and start the journey to finding your new car or used car for sale in Dubai, Sharjah, Abu Dhabi and Ajman.

Or, for more information about financing a car in the UAE and what paperwork you need, click here.